In February 2022, the variable cost incurred was $3,000, which includes raw materials, electricity, and labor. For Greg and many other retail businesses, success is heavily reliant on having a profitable cost per unit — and half of that battle is keeping your costs low. By leveraging the insights and strategies outlined in this comprehensive guide, businesses can navigate the complex landscape of cost per unit analysis and drive sustainable growth.

- Businesses can proactively identify cost reduction opportunities by conducting regular cost audits and analysis.

- For example, working with a wholesale distributor will likely offer you better rates for inventory replenishment.

- The average cost represents the standard cost incurred per unit of production.

- This calculator is particularly useful for businesses, manufacturers, and entrepreneurs looking to analyze their production costs and make informed pricing decisions.

- The total production cost is found by adding up the total fixed cost and the total variable cost.

How WareIQ Helps Reduce Fulfillment Costs Per Unit

I can see the granular stage the order is in — if it’s being picked, packed, in transit, etc. In turn, this can help you deliver orders to customers more affordably while keeping product prices competitive. Greg’s Apothecary produces scented candles for an average of $10 per unit. It costs Greg’s biggest competitor $8 on average to create a similar candle. Short multiple-choice tests, you may evaluate your comprehension of Inventory Management. The most common automation systems will turn automatic sprinklers on and off during the day, or lights in the house on and off while you’re out of town.

Total fixed costs

Regularly evaluating supplier performance and exploring alternative sourcing options can further optimize costs. Note that if you measure the room in inches, the result will be in square inches. If you measure it in yards, it will be in square yards, and so on with metric units such as centimeters and meters (results in sq cm and sq m respectively). To get a result in square feet, make sure the input measurements are in square feet as well (you can remember it as “ft to sq ft”). Activity-based costing uses cost drivers to assign the costs of resources to activities, along with unit cost as a way of measuring output. By adopting effective customer management practices, you can ensure timely order fulfillment and enhance customer satisfaction with their purchases.

To Ensure One Vote Per Person, Please Include the Following Info

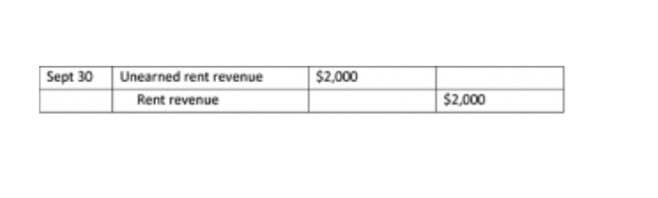

The total fixed costs include expenses that remain constant regardless of the volume of units produced, such as rent, insurance, and administrative costs. On the other hand, variable costs fluctuate in proportion to the number of units produced, including direct labor costs, direct material costs, and packaging expenses. Understanding and calculating the cost per unit is a fundamental aspect of running a profitable business. Optimizing the cost per unit through operational efficiency, strategic supplier management, and cost reduction initiatives can lead to improved profitability and a competitive edge in the market. The Cost Per Unit Calculator is a valuable tool used to determine the cost per unit of a product or service based on the total cost and the number of units produced or provided. This calculator is particularly useful for businesses, manufacturers, and entrepreneurs looking to analyze their production costs and make informed pricing decisions.

Take the case of a small ecommerce business called PetsCo, which produced 100 units of an 80 lb bag of premium dog food in February 2022. Additionally, a how to calculate cost per unit lower cost per unit can also identify gaps in internal efficiencies. Doing things on the cheap can only lead to more expensive repairs down the road.

- To calculate the cost per unit, simply divide the total cost by the total number of units.

- Thus, these costs are crucial to shaping your company’s budgeting process.

- Examples of fixed costs are factory rent, utilities, direct labor costs/salaries, insurance premiums, property taxes, and lease payments for machinery or equipment.

- It is essential to consider both fixed and variable costs when using the Cost Per Unit Calculator, as they can impact the overall cost per unit.

- EPS is a key performance indicator used by shareholders to assess performance.

Variable costs, on the other hand, increase or decrease based on the volume of production. Cost per unit is the sum of all the expenses that a company https://www.bookstime.com/ incurs to produce, store and sell one unit of a product or a service. They are classified into two groups – fixed costs and variable costs.

Cost Per Unit vs. Price Per Unit

- Variable costs, on the other hand, increase or decrease based on the volume of production.

- Instead of having to handle all SKU management and logistics on your own, you can outsource it to ShipBob and save time, energy, and money.

- We hope this has been a helpful guide to the marginal cost formula and how to calculate the incremental cost of producing more goods.

- Yet, you decide to sell each cookie to customers at $2.50, which is the price per unit.

- Examples of step costs are adding a new production facility or production equipment, adding a forklift, or adding a second or third shift.

Being static, they enable you to forecast financial obligations over time and plan your budget accordingly. Thus, these costs are crucial to shaping your company’s budgeting process. Broadly, the total cost of production is composed of two parts, as expressed by the following formula.

Payment Based on Utilised Storage Space

A unit cost is the total expenditure incurred by a company to produce, store, and sell one unit of a particular product or service. Be aware that the product life cycle is becoming shorter and people’s shopping habits also constantly change. Optimise inventory levels to reduce wastage and also logistics costs. Set up inventory buffers to prevent problems across the supply chain and avoid overselling and underselling inventory across marketplace channels. Moreover, Flowspace offers an in-depth product inventory management system, granting brands full transparency over their stock.

What are the benefits of activity-based costing?

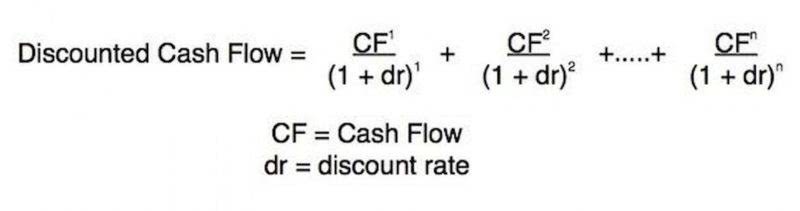

If the selling price for a product is greater than the marginal cost, then earnings will still be greater than the added cost – a valid reason to continue production. If, however, the price tag is less than the marginal cost, losses will be incurred and therefore additional production should not be pursued – or perhaps prices should be increased. This is an important piece of analysis to consider for business operations.